- Email: info@finobridge.com

- (+91) 96633 94131 | (+91) 98867 98339

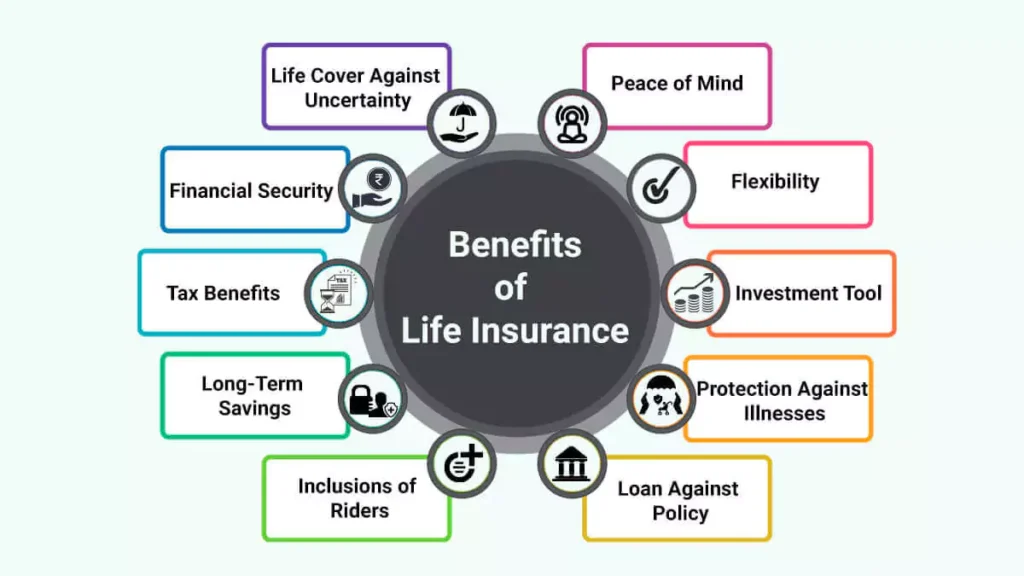

Insurance cover has become one of the most essential things in our life, same as we need food, shelter etc. The importance of an insurance cover, we realised in COVID-19 era. An insurance cover protects us from financial loss and ensure that we shall get better medical and financial adds.

a) Term Life Insurance: Provides a death benefit to your beneficiaries if you pass away during the policy term.

b) Whole Life Insurance: Offers a death benefit and a cash value component that grows over time.

c) Endowment Plans: Combine life insurance with savings elements, offering a lump sum payment at the end of the policy term.

d) ULIPs (Unit Linked Insurance Plans): Invest your premium in a variety of market-linked funds and provide a death benefit.

e) Group Life Insurance: Common employee benefit that provides a death benefit to the insured’s beneficiaries if they die while part of the organization. The purpose is to provide financial support to the families of such employees.

a) Individual Health Insurance: Covers medical expenses for you and your family.

b) Family Floater Health Insurance: Covers medical expenses for your entire family under a single policy.

c) Critical Illness Insurance: Pays a lump sum benefit if you are diagnosed with a critical illness

a) Third-Party Liability Insurance: Mandatory in India, it covers damages caused to third-party property or injury.

b) Comprehensive Insurance: Covers damages to your vehicle, third-party liability, and personal accident cover.

Covers damages to your home and its contents due to fire, theft, natural disasters, or other perils.

Provides coverage for medical expenses, trip cancellation, lost baggage, and other travel-related risks.

a) Assess Your Needs: Determine the type and amount of coverage you require based on your lifestyle, income, and family responsibilities.

b) Compare Policies: Obtain quotes from multiple insurers and compare premiums, coverage, and terms.

c) Read the Fine Print: Carefully review the policy documents to understand the terms, conditions, and exclusions.

d) Consider Customer Service: Choose an insurer with a good reputation for after sales service.

e) Waiting Periods: Some policies may have waiting periods before certain benefits become effective.

f) Sub-limits: Certain types of claims may have lower coverage limits.

g) Read Exclusions Carefully: Be aware of any activities or conditions that are not covered by the policy.

Choose an appropriate insurance cover to avoid financial distress at the time of accident/damage / unforeseen events. Insurance is the need of the day, and you must think before some event happens.

Disclaimer: Please refer to policy wordings and prospectus before concluding the sales.

Admin