- Email: info@finobridge.com

- (+91) 96633 94131 | (+91) 98867 98339

The insurer provides a lump sum payment for the treatment of covered critical illnesses upon their first diagnosis.

Regular mediclaim insurance plans cover critical diseases to the extent of hospitalization expenses only. They reimburse the expenses incurred on treating a critical illness during hospitalization. However, critical illness insurance plans provide a lump sum amount upon diagnosis of covered critical illnesses that can be used to pay for healthcare expenses with or without hospitalization.

Patients diagnosed with a critical illness cannot earn as they used to due to the physical limitations of going to work every day. On top of that, there will be a huge burden of medical expenses incurred on the treatment of the disease. Buying a critical illness insurance policy is a foolproof way of securing the entire family’s future against critical illnesses, as the lump sum claim amount can be used not only to pay medical bills and day-to-day home expenses.

The need for a critical illness policy nowadays is more than ever. The sedentary lifestyle of the 21st century is giving rise to all kinds of illnesses, most of which are critical in nature. While the number of people developing/ contracting critical illness is increasing, the age at which people develop critical illnesses is consistently decreasing. This means that millennials are prone to developing critical illnesses as compared to the earlier generations. By buying a critical illness policy at an early age, young adults can safeguard themselves against the financial implications of these diseases while affording the best available treatment.

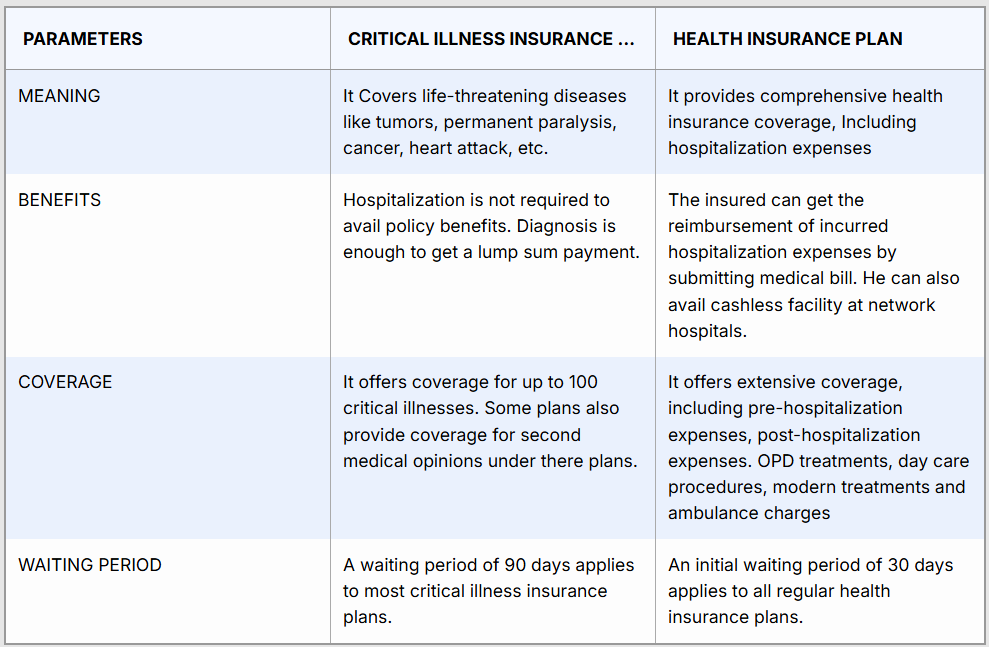

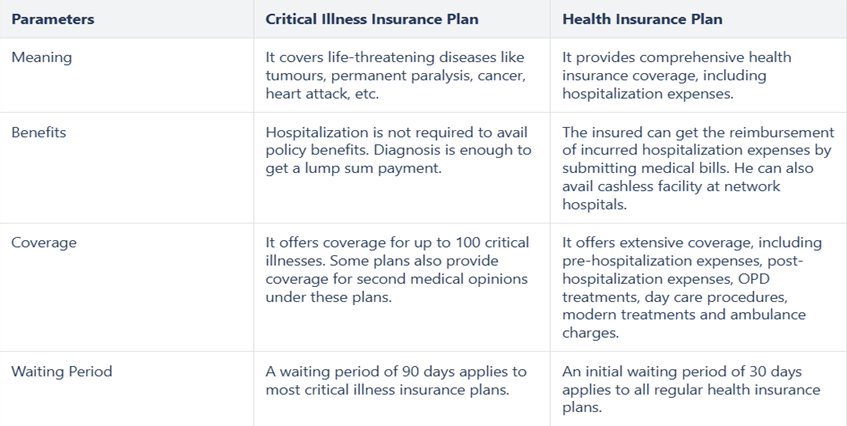

| Parameters | Critical Illness Insurance Plan | Health Insurance Plan |

|---|---|---|

| Meaning | It Covers life-threatening diseases like tumors, permanent paralysis, cancer, heart attack, etc. | It provides comprehensive health insurance coverage, Including hospitalization expenses |

| Benefits | Hospitalization is not required to avail policy benefits. Diagnosis is enough to get a lump sum payment. | The insured can get the reimbursement of incurred hospitalization expenses by submitting medical bill. He can also avail cashless facility at network hospitals. |

| Coverage | It offers coverage for up to 100 critical illnesses. Some plans also provide coverage for second medical opinions under there plans. | It offers extensive coverage, including pre-hospitalization expenses, post-hospitalization expenses. OPD treatments, day care procedures, modern treatments and ambulance charges |

| Waiting Period | A waiting period of 90 days applies to most critical illness insurance plans. | An initial waiting period of 30 days applies to all regular health insurance plans. |