- Email: info@finobridge.com

- (+91) 96633 94131 | (+91) 98867 98339

SIPs tend to promote regular and disciplined investing. Through a fixed amount regularly, investors can build the habit of investing.

The power of compounding works best when the investments are made for a long period of time, on a regular basis. SIPs let investors benefit from compounding returns, as the returns generated are reinvested.

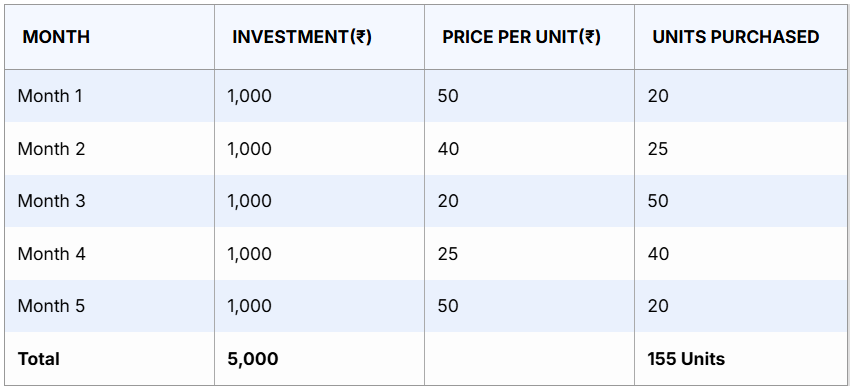

SIPs help investors with rupee cost averaging. Rupee cost averaging means that when the market is down, you will buy more units, and when the market is up, you will buy fewer units with SIPs. This helps to spread the effect of market movements on the investments.

SIPs are a more convenient form of investment. You can automate SIPs to a mutual fund scheme through a bank mandate and ensure that a fixed amount is deducted from your bank account and invested in the chosen mutual fund scheme.

SIPs come up as affordable investments since you can start investing with a small amount, which makes it affordable. This can mainly be useful for young investors, or those with limited funds to begin investing.

SIPs offer flexibility in terms of the amount of SIP you want to invest and the frequency of investment, such as monthly, quarterly, and more. You could also increase or decrease your SIP amount according to your financial situation.

Mutual fund schemes are managed by professional fund managers, and they have expertise to analyze and select the best investment opportunities, providing investors with more possibilities of achieving their financial goals.

Investing through SIPs in mutual fund schemes offer diversification across different asset classes based on the kind of mutual fund it is – such as, sectors, geographies, and more.

Passively managed mutual funds are investment funds that aim to replicate the performance of a specific market index or benchmark rather than trying to outperform it. The primary goal of these funds is to mirror the returns of the chosen index as closely as possible, and investors can invest in these funds through SIP method too.

In this SIP, you will invest a fixed amount at regular intervals.

This SIP allows investors to change the investment amount or skip investments at their convenience.

Regular SIPs usually have an end date, but perpetual SIPs continue until the investor decides to stop them.

This allows you to set certain triggers for investments, such as a particular date, NAV level, or index level.

You can use a single SIP to invest in multiple mutual fund schemes.

This form of SIP is like a top-up SIP, but the increase in investment amount is predefined and occurs at regular intervals.